Essay

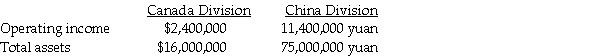

The Irnakk Corporation manufactures iPod covers in Canada and China.The operations are organized as decentralized divisions.The following information is available for the year just ended:

The exchange rate at the time of Irnakk's investment (the end of the previous year)in China was 7.5 Chinese yuan = $1 Canadian.During the year,the yuan declined steadily in value and the exchange rate at the end of the current year was 8.5 yuan = $1 Canadian.The average exchange rate during the year was 8 yuan = $1 Canadian.

Required:

a.Calculate the Canadian Division's ROI for last year based on dollars.

b.Calculate the Chinese Division's ROI for last year based on yuan.

c.Which of Irnakk's two divisions earned the better ROI? Explain your answer,complete with supporting calculations showing the China Division ROI in Canadian dollars.

Correct Answer:

Verified

a.Canadian Division's ROI for the year =...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Use the information below to answer the

Q32: Use the information below to answer the

Q43: The "four levers" of control are operating

Q62: Answer the following question(s)using the information below:<br>Carriage

Q84: Benchmarks represent 'best practices', and can be

Q106: Hargrave Products has three divisions which operate

Q118: Measures which monitor critical performance variables that

Q131: Answer the following question(s)using the information below:<br>Coldbrook

Q146: In establishing performance measures and compensation policy,

Q147: A company has total assets of $500,000,