Essay

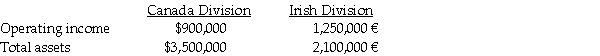

The Shamrock Corporation manufactures flower pots in Canada and Ireland.The operations are organized as decentralized divisions.The following information is available for the year just ended:

The exchange rate at the time of Shamrock's investment (the end of the previous year)in Ireland was $1.35 Canadian to 1.00 Euro.During the year,the Euro weakened steadily in value and the exchange rate at the end of the current year was 1.24 Canadian = $1.00 Euro.The average exchange rate during the year was 1.28 Canadian = $1.00 Euro.

Required:

a.Calculate the Canadian Division's ROI for last year based on dollars.

b.Calculate the Irish Division's ROI for last year based on Euros.

c.Which of Shamrock's two divisions earned the better ROI? Explain your answer,complete with supporting calculations showing the Irish Division ROI in Canadian dollars.

Correct Answer:

Verified

a.Canadian Division's ROI for the year =...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Bob Cellular Phone uses ROI to measure

Q38: Companies are increasingly using nonfinancial measures to

Q67: Economic value added is after-tax operating income

Q71: Which of the following is the LEAST

Q105: Endicott Inc.has four divisions.Each division produces and

Q123: An interactive control system is a formal

Q140: Use the information below to answer the

Q142: The most popular approach to incorporating the

Q156: Paymaster Company provided the following information for

Q158: The Auto Division of Fran Corporation has