Essay

Hendricks Ltd.of Calgary manufactures and sells computers.The Manufacturing Division is located in China and transfers 75% of its output to the Assembly Division in the Philippines.The balance of the product is sold in the local market at 2,100 yuan/unit.The Philippines division sells 20% of its output in the local market at 31,500 pesos/unit,with the balance shipped to Calgary.The Calgary operation packages the units and sells the final product at $1,900 Canadian per unit.

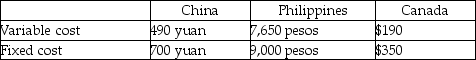

The following budget data are available:

Exchange rates are: $1 Canadian = 7 yuan and $1 Canadian = 45 pesos

Tax rates are 45% in China,20% in the Philippines and 40% in Canada.Income taxes are not included in the calculation of cost-based transfer prices.Assume that Hendricks does not pay Canadian tax on amounts already taxed in foreign jurisdictions.Take each calculation to 2 decimal places.

Required:

The company has determined that it may transfer units at 250% of variable cost or at market and comply with all existing tax legislation.Which transfer pricing method should the company pursue? Support your recommendation with appropriate calculations.

Correct Answer:

Verified

First translate the foreign currencies i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: If the product sold between divisions has

Q12: Use the information below to answer the

Q22: The degree of freedom to make decisions

Q41: Management control systems reflect only financial data.

Q47: A management control system would include both

Q59: Better Food Company recently acquired an olive

Q61: Answer the following question(s)using the information below.Beta

Q79: Which of the following statements is FALSE?<br>A)A

Q98: Briefly explain each of the three general

Q160: Answer the following question(s)using the information below.Beta