Multiple Choice

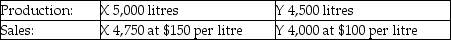

Use the information below to answer the following question(s) .Chem Manufacturing Company processes direct materials up to the splitoff point, where two products (X and Y) are obtained and sold.The following information was collected for the month of November.Direct materials processed:

10,000 litres (10,000 litres yield 9,500 litres of good product and 500 litres of shrinkage)

The cost of purchasing 10,000 litres of direct materials and processing it up to the splitoff point to yield a total of 9,500 litres of good products was $975,000.The beginning inventories totalled 50 litres for X and 25 litres for Y.Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y.October costs were per unit were the same as November.

The cost of purchasing 10,000 litres of direct materials and processing it up to the splitoff point to yield a total of 9,500 litres of good products was $975,000.The beginning inventories totalled 50 litres for X and 25 litres for Y.Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y.October costs were per unit were the same as November.

-Product X is sold for $8 a unit and Product Y is sold for $12 a unit.Each product can also be sold at the splitoff point.Product X can be sold for $5 and Product Y for $4.Joint costs for the two products totaled $4,000 for January for 600 units of X and 500 units of Y.What are the respective joint costs assigned to each unit of products X and Y if the sales value at splitoff method is used?

A) $2.96 and $4.44

B) $4.00 and $4.55

C) $4.00 and $3.20

D) $4.55 and $4.55

E) $3.20 and $4.00

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Answer the following question(s)using the information below.The

Q51: Use the information below to answer the

Q53: Different joint cost allocation methods will result

Q54: BC Lumber processes timber into four products.During

Q56: All separable costs in joint-cost allocations are

Q57: Trundle Ltd.produces two main products, J and

Q59: The sales value at splitoff method allocates

Q60: Answer the following question(s)using the information below:<br>The

Q112: In each of the following industries, identify

Q120: Distinguish between the two principal methods of