Essay

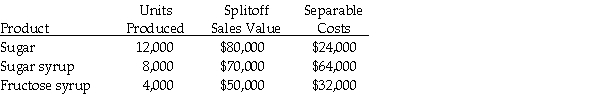

Sweet Sugar Company processes sugar beets into three products.During April the joint costs of processing were $240,000.Production and sales value information for the month were as follows:

Sales Value at

Required:

Determine the amount of joint cost allocated to each product if the sales value at splitoff method is used.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: The net realizable value method can be

Q17: What type of cost is the result

Q35: Golden Company uses one raw material, gold

Q37: Scrap frequently has a zero sales value.

Q59: The sales value at splitoff method allocates

Q63: Use the information below to answer the

Q110: The amount of the joint costs is

Q130: North York Statue Company makes miniature Mountie

Q151: Which of the following is FALSE concerning

Q164: Recognizing byproduct cost at the time of