Multiple Choice

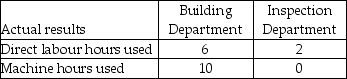

Leonard Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs.The company has two departments: Building and Inspection.The Building Department uses a departmental overhead rate of $18 per machine hour,while the Inspection Department uses a departmental overhead rate of $15 per direct labour hour.Job 611 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 611 is $1,500.

What was the total cost of Job 611 if Leonard Industries used the departmental overhead rates to allocate manufacturing overhead?

A) $1,700

B) $1,844

C) $1,880

D) $1,838

E) $1,910

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If the cost of an activity increases

Q12: Which of the following is relevant concerning

Q60: When using activity-based costing in a manufacturing

Q69: List four ways that activity-based management can

Q88: Come-On-In Manufacturing produces two types of entry

Q96: Describe each of the four cost hierarchies

Q102: Answer the following questions using the information

Q112: Which of the following statements does not

Q117: Answer the following question(s)using the information below.Ernsting

Q130: Direct cost tracing will accomplish which of