Essay

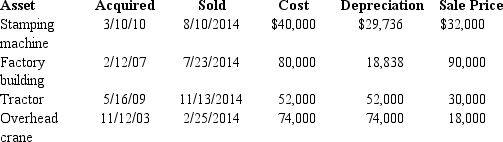

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as longterm capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Correct Answer:

Verified

The stamping machine ($21,736),tractor (...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: If § 1231 asset casualty gains and

Q16: The maximum § 1245 depreciation recapture generally

Q52: Describe the circumstances in which the maximum

Q57: Part III of Form 4797 is used

Q60: Charmine,a single taxpayer with no dependents,has already

Q61: For § 1245 recapture to apply, accelerated

Q64: A business machine purchased April 10,2013,for $62,000

Q67: A business machine purchased April 10,2012,for $98,000

Q69: Verway,Inc. ,has a 2014 net § 1231

Q70: Vertigo,Inc. ,has a 2014 net § 1231