Essay

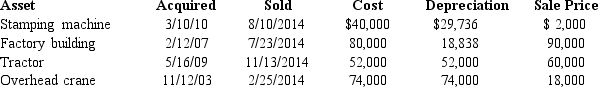

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as longterm capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Describe the circumstances in which the potential

Q3: Which of the following creates potential §

Q7: Which of the following events could result

Q8: A retail building used in the business

Q9: An individual had the following gains and

Q11: An individual taxpayer has the gains

Q12: Depreciation recapture under § 1245 and §

Q24: Rental use depreciable machinery held more than

Q33: Which of the following is correct?<br>A)Improperly classifying

Q48: An individual business taxpayer owns land on