Essay

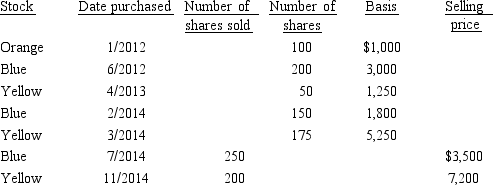

Omar has the following stock transactions during 2014:

a.What is Omar's recognized gain or loss on the stock sales if his objective is to minimize the recognized gain and to maximize the recognized loss?

b.What is Omar's recognized gain or loss if he does not identify the shares sold?

Correct Answer:

Verified

a.Since Omar's objective is to minimize ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Mona purchased a business from Judah

Q33: Emma gives her personal use automobile (cost

Q36: Carlton purchases land for $550,000.He incurs legal

Q39: Lois received nontaxable stock rights with a

Q64: Peggy uses a delivery van in her

Q66: Explain how the sale of investment property

Q117: Identify two tax planning techniques that can

Q190: Joseph converts a building (adjusted basis of

Q234: What is the easiest way for a

Q252: The taxpayer owns stock with an adjusted