Essay

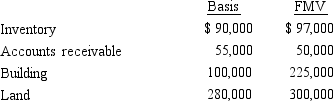

Hubert purchases Fran's jewelry store for $950,000.The identifiable assets of the business are as follows:

Hubert and Fran agree to assign $110,000 to a 7-year covenant not to compete.How should Hubert allocate the $950,000 purchase price to the assets?

Hubert and Fran agree to assign $110,000 to a 7-year covenant not to compete.How should Hubert allocate the $950,000 purchase price to the assets?

Correct Answer:

Verified

The purchase price is allocate...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: Milton purchases land and a factory building

Q48: Steve purchased his home for $500,000.As a

Q51: Karen purchased 100 shares of Gold Corporation

Q55: Karen owns City of Richmond bonds with

Q56: Parker bought a brand new Ferrari on

Q57: Lump-sum purchases of land and a building

Q57: Ed and Cheryl have been married for

Q58: Jason owns Blue Corporation bonds (face value

Q67: If a taxpayer purchases taxable bonds at

Q248: If property that has been converted from