Essay

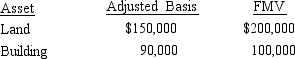

On September 18,2014,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2011,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid no gift tax on the transfer to Jerry.

Ted paid no gift tax on the transfer to Jerry.

a.Determine Jerry's adjusted basis and holding period for the land and building.

b.Assume instead that the FMV of the land was $89,000 and the FMV of the building was $60,000.Determine Jerry's adjusted basis and holding period for the land and building.

Correct Answer:

Verified

d.As the fair market value of each asset...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: A realized loss whose recognition is postponed

Q45: If the fair market value of the

Q51: Purchased goodwill is assigned a basis equal

Q54: Ken is considering two options for selling

Q87: 51. Albert purchased a tract of land for

Q90: Arthur owns a tract of undeveloped land

Q92: Gift property (disregarding any adjustment for gift

Q96: The basis of property acquired in a

Q178: Hilary receives $10,000 for a 15-foot wide

Q208: Morgan owned a convertible that he had