Multiple Choice

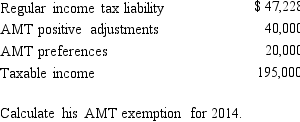

Ashby,who is single and age 30,provides you with the following information from his financial records for 2014.

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: If Jessica exercises an ISO and disposes

Q16: Negative AMT adjustments for the current year

Q24: Benita expensed mining exploration and development costs

Q32: A taxpayer who expenses circulation expenditures in

Q34: The deduction for personal and dependency exemptions

Q87: The AMT exemption for a corporation with

Q87: Mauve,Inc. ,has the following for 2012,2013,and 2014

Q96: Elmer exercises an incentive stock option (ISO)in

Q97: For regular income tax purposes,Yolanda,who is single,is

Q112: What tax rates apply in calculating the