Multiple Choice

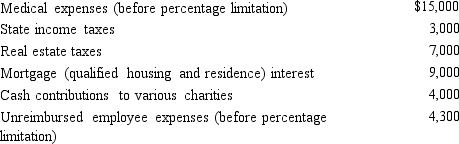

Mitch,who is single and age 66 and has no dependents,had AGI of $100,000 in 2014.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2014?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2014?

A) $14,800

B) $16,800

C) $19,300

D) $25,800

E) None of these

Correct Answer:

Verified

Correct Answer:

Verified

Q9: In determining the amount of the AMT

Q32: The amount of the deduction for medical

Q43: Certain adjustments apply in calculating the corporate

Q58: Sage,Inc. ,has the following gross receipts and

Q67: Kay had percentage depletion of $119,000 for

Q84: Income from some long-term contracts can be

Q91: Melinda is in the 35% marginal tax

Q103: The sale of business property might result

Q111: How can an AMT adjustment be avoided

Q122: Durell owns a construction company that builds