Multiple Choice

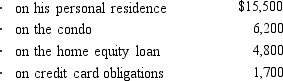

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2014,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2014,he paid the following amounts of interest:  What amount,if any,must Ted recognize as an AMT adjustment in 2014?

What amount,if any,must Ted recognize as an AMT adjustment in 2014?

A) $0

B) $4,800

C) $6,200

D) $11,000

E) None of these

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Why is there no AMT adjustment for

Q31: Interest income on private activity bonds issued

Q77: Prior to the effect of the tax

Q78: How can the positive AMT adjustment for

Q79: Ashly is able to reduce her regular

Q80: The required adjustment for AMT purposes for

Q81: Gunter,who is divorced,has the following items for

Q84: Omar acquires used 7-year personal property for

Q86: Bianca and David have the following for

Q87: Mauve,Inc. ,has the following for 2012,2013,and 2014