Essay

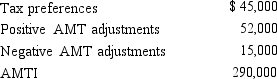

Use the following selected data to calculate Devon's taxable income.

Correct Answer:

Verified

AMTI $290,000

Plus: Negative A...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

AMTI $290,000

Plus: Negative A...

Plus: Negative A...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q5: Prior to the effect of tax credits,Clarence's

Q6: Lilly is single and has no taxable

Q8: Madge's tentative AMT is $112,000.Her regular income

Q11: Sand Corporation,a calendar year taxpayer,has alternative minimum

Q24: If a gambling loss itemized deduction is

Q30: A taxpayer has a passive activity loss

Q50: What is the purpose of the AMT

Q54: If a taxpayer deducts the standard deduction

Q60: Because passive losses are not deductible in

Q86: In the current tax year,Ben exercised an