Multiple Choice

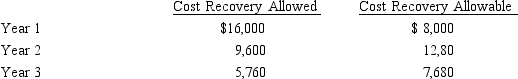

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are as follows:  If Tara sells the machine after three years for $15,000,how much gain should she recognize?

If Tara sells the machine after three years for $15,000,how much gain should she recognize?

A) $3,480

B) $6,360

C) $9,240

D) $11,480

E) None of these

Correct Answer:

Verified

Correct Answer:

Verified

Q5: George purchases used sevenyear class property at

Q6: James purchased a new business asset (three-year

Q7: On April 15,2014,Sam placed in service a

Q9: Nora purchased a new automobile on July

Q11: The amortization period in 2014 for $58,000

Q13: The statutory dollar cost recovery limits under

Q15: Discuss the difference between the half-year convention

Q65: Percentage depletion enables the taxpayer to recover

Q72: Any § 179 expense amount that is

Q84: Discuss the requirements in order for startup