Essay

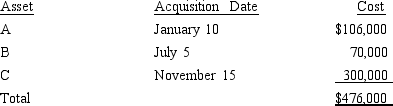

Audra acquires the following new five-year class property in 2014:

Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra does not take additional first-year depreciation (if available).Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra does not take additional first-year depreciation (if available).Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Correct Answer:

Verified

$300,000/$476,000 = 63%.Theref...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: For real property, the ADS convention is

Q21: All listed property is subject to the

Q49: On July 15,2014,Mavis paid $275,000 for leasehold

Q49: Property which is classified as personalty may

Q51: Alice purchased office furniture on September 20,2013,for

Q52: Sid bought a new $180,000 seven-year class

Q53: Cora purchased a hotel building on May

Q56: Under MACRS, if the mid-quarter convention is

Q87: Discuss the reason for the inclusion amount

Q106: Antiques may be eligible for cost recovery