Multiple Choice

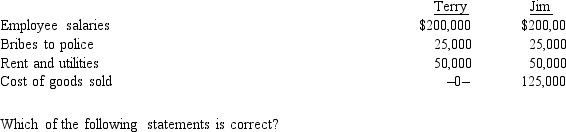

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.

A) Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B) Terry should report profit from his business of $250,000.

C) Jim should report profit from his business of $500,000.

D) Jim should report profit from his business of $250,000.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Describe the circumstances under which a taxpayer

Q22: Investigation of a business unrelated to one's

Q29: In order to protect against rent increases

Q31: Which of the following is incorrect?<br>A)Alimony is

Q36: Which of the following statements is correct

Q48: Deductions are allowed unless a specific provision

Q60: Trade or business expenses are classified as

Q87: What losses are deductible by an individual

Q122: What is the appropriate tax treatment for

Q137: Bridgett's son, Clyde, is $12,000 in arrears