Multiple Choice

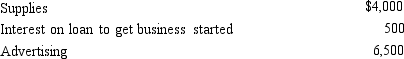

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

A) Include $10,000 in income and deduct $11,000 for AGI.

B) Ignore both income and expenses since hobby losses are disallowed.

C) Include $10,000 in income,deduct nothing for AGI,and claim $11,000 of the expenses as itemized deductions.

D) Include $10,000 in income and deduct interest of $500 for AGI.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Legal fees incurred in connection with a

Q12: Kitty runs a brothel (illegal under

Q12: If a taxpayer operated an illegal business

Q16: Sammy,a calendar year cash basis taxpayer

Q18: Paula is the sole shareholder of Violet,Inc.For

Q19: While she was a college student,Angel lived

Q44: Jacques, who is not a U.S.citizen, makes

Q73: A hobby activity can result in all

Q96: Which of the following are deductions for

Q121: Why are there restrictions on the recognition