Essay

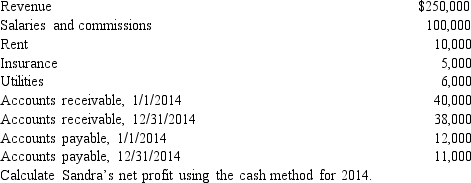

Sandra owns an insurance agency.The following selected data are taken from the agency balance sheet and income statement prepared using the accrual method.

Correct Answer:

Verified

Sandra's accrual method net profit is ca...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Isabella owns two business entities.She may be

Q20: Agnes operates a Christmas Shop in Atlantic

Q68: Which of the following may be deductible?<br>A)Bribes

Q91: If a vacation home is classified as

Q93: Legal expenses incurred in connection with rental

Q95: In determining whether an activity should be

Q96: Hobby activity expenses are deductible from AGI

Q104: If a taxpayer operates an illegal business,

Q105: The portion of a shareholder-employee's salary that

Q140: Bobby operates a drug-trafficking business. Because he