Essay

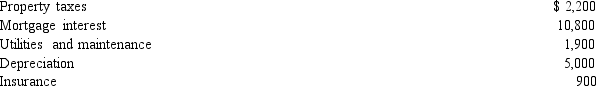

During the year,Rita rented her vacation home for twelve days for $2,400 and she used it personally for three months.The following expenses were incurred on the home:

Calculate her rental gain or loss and itemized deductions.

Calculate her rental gain or loss and itemized deductions.

Correct Answer:

Verified

Rita excludes the $2,400 of rental incom...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Which of the following is not deductible?<br>A)Moving

Q7: Expenses incurred for the production or collection

Q12: If a taxpayer operated an illegal business

Q12: Kitty runs a brothel (illegal under

Q36: The portion of property tax on a

Q40: The cost of legal advice associated with

Q44: Jacques, who is not a U.S.citizen, makes

Q73: A hobby activity can result in all

Q99: Which of the following can be claimed

Q121: Why are there restrictions on the recognition