Essay

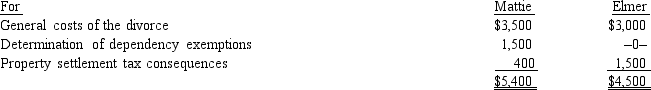

Mattie and Elmer are separated and are in the process of obtaining a divorce.They incur legal fees for their respective attorneys with the expenses being itemized as follows:

Although there is no requirement that he do so,Elmer pays Mattie's lawyer as a gesture of the positive feelings he still has for her.

Although there is no requirement that he do so,Elmer pays Mattie's lawyer as a gesture of the positive feelings he still has for her.

a.Determine the deductions for Mattie and for Elmer.

b.Classify the deductions as for AGI and from AGI.

Correct Answer:

Verified

a.Only the legal fees associated with th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Depending on the nature of the expenditure,

Q11: Assuming an activity is deemed to be

Q38: Two-thirds of treble damage payments under the

Q61: Purchased goodwill must be capitalized but can

Q87: Under what circumstances may a taxpayer deduct

Q100: Fines and penalties paid for violations of

Q110: Trade and business expenses should be treated

Q111: Which of the following is a required

Q112: During the year,Martin rented his vacation home

Q115: Which of the following is a deduction