Essay

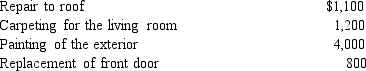

Marvin spends the following amounts on a house he owns:

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

Correct Answer:

Verified

a.Since these expenditures are personal ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: If a vacation home is classified as

Q19: Graham, a CPA, has submitted a proposal

Q60: None of the prepaid rent paid on

Q64: Iris,a calendar year cash basis taxpayer,owns and

Q66: Andrew,who operates a laundry business,incurred the following

Q67: Alfred's Enterprises,an unincorporated entity,pays employee salaries of

Q79: An expense need not be recurring in

Q85: If a vacation home is classified as

Q143: Bruce owns several sole proprietorships. Must Bruce

Q144: A vacation home at the beach which