Essay

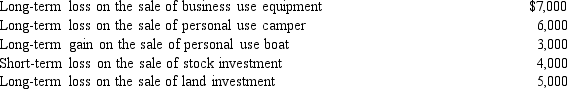

During the year,Irv had the following transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

Ordinary loss of $7,000 on the business ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Ordinary loss of $7,000 on the business ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q19: Lee, a citizen of Korea, is a

Q62: Matching <br>Regarding classification as a dependent, classify

Q69: Match the statements that relate to each

Q74: Matching <br>Regarding classification as a dependent, classify

Q77: Married taxpayers who file separately cannot later

Q122: Adjusted gross income (AGI) sets the ceiling

Q180: A child who has unearned income of

Q181: Perry is in the 33% tax

Q182: Warren,age 17,is claimed as a dependent by

Q184: Emily,whose husband died in December 2013,maintains a