Short Answer

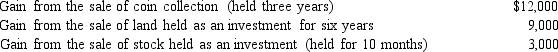

During 2014,Jackson had the following capital gains and losses:

a.How much is Jackson's tax liability if he is in the 15% tax bracket?

b.If his tax bracket is 33% (not 15%)?

Correct Answer:

Verified

b.$5,700.(33% × $3,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Matching <br>Regarding classification as a dependent, classify

Q26: Mr. Lee is a citizen and resident

Q41: Regarding the rules applicable to filing of

Q59: During 2014,Madison had salary income of

Q61: Derek,age 46,is a surviving spouse.If he has

Q75: Match the statements that relate to each

Q76: Since an abandoned spouse is treated as

Q121: Surviving spouse filing status begins in the

Q122: All exclusions from gross income are reported

Q176: Kim, a resident of Oregon, supports his