Multiple Choice

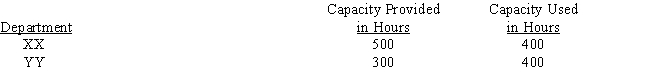

A company incurred £120,000 of common fixed costs and £180,000 of common variable costs. These costs are to be allocated to Departments XX and YY. Data on capacity provided and capacity used are as follows: Assume that common fixed costs are to be allocated to Departments XX and YY on the basis of capacity provided and that common variable costs are to be allocated to Departments XX and YY on the basis of capacity used. The fixed and variable costs allocated to Department XX are

A) £75,000 £112,500

B) £75,000 £90,000

C) £60,000 £112,500

D) £60,000 £90,000

Correct Answer:

Verified

Correct Answer:

Verified

Q7: When applied overhead exceeds actual overhead cost,<br>A)over-applied(absorbed)

Q23: Support departments<br>A)are responsible for manufacturing the products

Q44: Examples of support departments include all of

Q52: The Greenbriar plant has two categories of

Q53: If conventional manufacturing is used, which of

Q54: Which of the following describes the product

Q55: A company incurred £20,000 of common fixed

Q58: The following information is provided for the

Q59: Figure 3<br>Ray Manufacturing has four categories of

Q61: Zang Company manufactures two products (X and