Essay

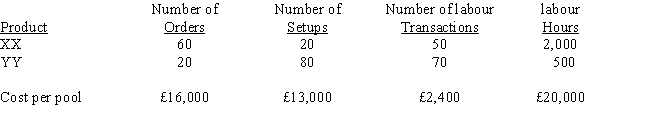

Hunter Company manufactures two products (XX and YY). The overhead costs have been divided into four cost pools that use the following activity drivers:

Required:

a.

Compute the allocation rates for each of the activity drivers listed.

b.

Allocate the overhead costs to Products XX and YY using activity-based costing.

c.

Compute the overhead rate using labour hours under the traditional functional-based costing system.

d.

Allocate the overhead costs to Products XX and YY using the traditional functional-based costing system overhead rate calculated in part (c).

Correct Answer:

Verified

Correct Answer:

Verified

Q11: In an activity-based cost system, what types

Q30: An activity-based costing system uses which of

Q42: All of the following are nonunit-based activity

Q45: Identify Cooper and Kaplan's four categories of

Q50: Maintenance of the production equipment would be

Q99: The activity-based approach to break-even costing emphasizes<br>A)

Q101: Zipp Company manufactures two products (X and

Q104: Flexible resources<br>A) are supplied as needed.<br>B) are

Q105: Baker Manufacturing has four categories of overhead.

Q108: Figure 5<br>Peach, SA., has identified the following