Essay

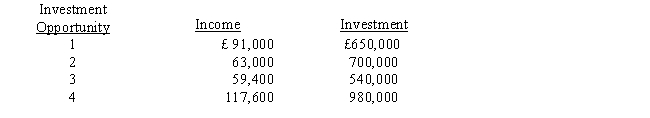

The manager of the recently formed Oak Division of Parkes, Incorporated, is evaluating the following four investment opportunities available to the division. Parkes, Incorporated, requires a minimum return of 10 percent.

Required:

a.

Calculate the return on investment (ROI) for each investment opportunity.

b.

If only one investment opportunity can be funded and the division is evaluated based on ROI, which investment opportunity would be accepted?

c.

If Parkes, Incorporated, can fund all of the projects and wishes to achieve the best possible performance, which investments would be accepted?

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A negative EVA means<br>A) the company is

Q9: A possible disadvantage of a decentralized organization

Q12: Decentralization occurs when<br>A)the firm's operations are located

Q20: A firm has £1,000,000 of long-term bonds

Q76: Return on investment (ROI) is calculated as<br>A)

Q79: The following information is provided: Assume the

Q81: Figure 6<br>The following results for the year

Q83: Discuss the differences between centralized and decentralized

Q85: Stevens Company has two divisions that report

Q86: Compare and discuss the advantages and disadvantages