Multiple Choice

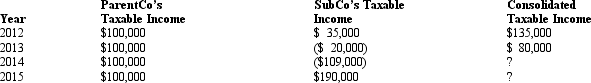

ParentCo and SubCo have filed consolidated returns since both entities were incorporated in 2012.Taxable income computations for the members include the following.Neither group member incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.  The 2014 consolidated loss:

The 2014 consolidated loss:

A) must be carried forward,unless an election to forgo carryforward is made by the parent.

B) must be carried back,unless an election to forgo the carryback is made by the parent.

C) can be used only to offset SubCo's future income.

D) cannot be used to offset any of ParentCo's 2012 income.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Outline the major advantages and disadvantages of

Q25: Which of the following is eligible to

Q29: How many consolidated tax returns are filed

Q33: Generally,when a subsidiary leaves an on-going consolidated

Q34: The _ rules can limit the net

Q75: A calendar year parent corporation wants to

Q111: In computing consolidated taxable income, compensation amounts

Q114: Most of the rules governing the use

Q114: For consolidated tax return purposes, purchased goodwill

Q148: Lacking elections to the contrary, Federal consolidated