Multiple Choice

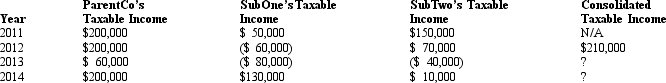

ParentCo,SubOne and SubTwo have filed consolidated returns since 2012.All of the entities were incorporated in 2011.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.  How should the 2013 consolidated net operating loss be apportioned among the group members?

How should the 2013 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

A) $60,000 $ 0 $ 0

B) $20,000 $20,000 $20,000

C) $ 0 $20,000 $40,000

D) $ 0 $40,000 $20,000

Correct Answer:

Verified

Correct Answer:

Verified

Q6: After a takeover, the parent's balance sheet

Q24: A Federal consolidated group can claim a

Q42: Describe the general computational method used by

Q64: When a subsidiary sells to the parent

Q74: Except for the § 199 domestic production

Q75: The U.S.states apply different rules in treating

Q77: A corporation organized outside of the U.S.can

Q81: If,on joining an affiliated group,SubCo has a

Q82: An affiliated group aggregates its separate charitable

Q83: The Philstrom consolidated group reported the following