Multiple Choice

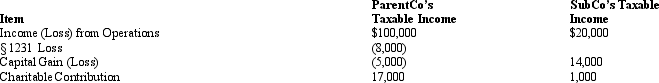

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $107,000.

B) $108,000.

C) $108,900.

D) $115,800.

E) $121,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: The consolidated tax return regulations use "SRLY"

Q57: Forming a Federal consolidated tax return group

Q81: When the net accumulated taxable losses of

Q98: List three "intercompany transactions" of a Federal

Q102: When the parent acquires 51% of a

Q103: ParentCo purchased all of the stock of

Q104: Calendar year ParentCo acquired all of the

Q106: Deferring recognition of an intercompany loss is

Q121: Members of a parent-subsidiary controlled group must

Q123: Which of the following entities is eligible