Essay

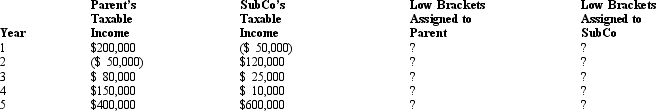

Parent Corporation owns 100% of the stock of SubCo,and the two corporations file a consolidated tax return.Over a five-year period,the corporations generate the following taxable income/(loss).Indicate how you would assign the taxpayers' low marginal rates that apply to the group's first $75,000 of taxable income.Explain the rationale for your recommendation.

Correct Answer:

Verified

The discounted rates must be assigned eq...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: Members of a controlled group share all

Q39: Within a Federal consolidated income tax group,SubOne

Q39: A joint venture, taxed like a partnership,

Q40: Which of the following tax effects becomes

Q41: The Philstrom consolidated group reported the following

Q43: Campbell Corporation left the Crane consolidated tax

Q44: Keep Corporation joined an affiliated group by

Q47: Consolidated estimated tax payments must begin for

Q72: In computing consolidated E & P, dividends

Q73: Cooper Corporation joined the Duck consolidated Federal