Essay

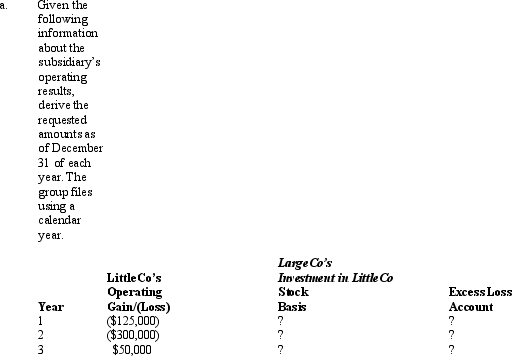

LargeCo files on a consolidated basis with LittleCo.The subsidiary was acquired for $400,000 on January 1,Year 1,and it paid a $75,000 dividend to LargeCo at the end of both Year 2 and Year 3.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q28: Conformity among the members of a consolidated

Q98: Which of the following statements is true

Q131: SubCo sells an asset to ParentCo at

Q132: A tax-exempt hospital cannot join in a

Q134: If subsidiary stock is redeemed or sold

Q135: To be part of a Federal consolidated

Q138: How are the members of a Federal

Q140: Compute consolidated taxable income for the calendar

Q141: Over time,the consolidated return rules have shifted

Q144: ParentCo owned 100% of SubCo for the