Essay

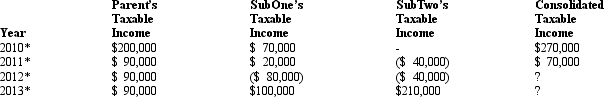

The group of Parent Corporation,SubOne,and SubTwo has filed a consolidated return since 2011.The first two entities were incorporated in 2010,and SubTwo came into existence in 2011 through an asset spin-off from Parent.Taxable income computations for the members are shown below.None of the group members incurred any capital gain or loss transactions during 2010-2013,nor did they make any charitable contributions.

Describe the treatment of the group's 2012 consolidated NOL.Hint: Apply the offspring rule.

* Consolidated return year.

* Consolidated return year.

Correct Answer:

Verified

Lacking an election by ParentCo to forgo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Keep Corporation joined an affiliated group by

Q47: Consolidated estimated tax payments must begin for

Q50: A limited partnership can join the parent's

Q51: The consolidated income tax return rules apply

Q54: Keep Corporation joined an affiliated group by

Q72: In computing consolidated E & P, dividends

Q73: Cooper Corporation joined the Duck consolidated Federal

Q101: Consolidated return members determine which affiliates will

Q117: In computing consolidated taxable income, the domestic

Q139: The domestic production activities deduction (DPAD) of