Multiple Choice

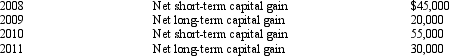

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2012.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2013.

Compute the amount of Bear's capital loss carryover to 2013.

A) $0.

B) $60,000.

C) $105,000.

D) $165,000.

E) $200,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Peach Corporation had $210,000 of active income,

Q32: On December 31, 2012, Lavender, Inc., an

Q37: Donald owns a 60% interest in a

Q47: Explain the rules regarding the accounting periods

Q53: On December 28,2012,the board of directors of

Q82: Lucinda is a 60% shareholder in Rhea

Q85: Katherine, the sole shareholder of Purple Corporation,

Q95: Robin Corporation, a calendar year C corporation,

Q97: Heron Corporation, a calendar year C corporation,

Q108: If a C corporation uses straight-line depreciation