Multiple Choice

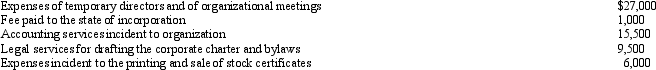

Emerald Corporation,a calendar year C corporation,was formed and began operations on April 1,2012.The following expenses were incurred during the first tax year (April 1 through December 31,2012) of operations:  Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2012?

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2012?

A) $0.

B) $4,550.

C) $5,000.

D) $7,400.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: In the current year, Plum Corporation, a

Q48: A personal service corporation with taxable income

Q50: George Judson is the sole shareholder and

Q64: Azure Corporation, a C corporation, had a

Q72: During the current year,Kingbird Corporation (a calendar

Q77: Which of the following statements is incorrect

Q99: Briefly describe the charitable contribution deduction rules

Q101: Rose is a 50% partner in Wren

Q103: A taxpayer is considering the formation of

Q110: Schedule M-2 is used to reconcile unappropriated