Essay

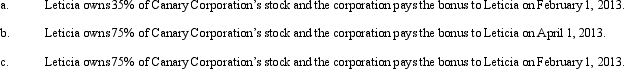

Canary Corporation,an accrual method C corporation,uses the calendar year for tax purposes.Leticia,a cash method taxpayer,is both a shareholder of Canary and the corporation's CFO.On December 31,2012,Canary has accrued a $75,000 bonus to Leticia.Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Correct Answer:

Verified

Under § 267(a)(2),an accrual method taxp...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Heron Corporation,a calendar year,accrual basis taxpayer,provides the

Q3: Juanita owns 60% of the stock in

Q8: Tonya,an actuary,is the sole shareholder of Shrike

Q11: Amber Company has $400,000 in net income

Q13: Employment taxes apply to all entity forms

Q20: An expense that is deducted in computing

Q21: Double taxation of corporate income results because

Q27: Briefly describe the accounting methods available for

Q42: The due date (not including extensions) for

Q83: Copper Corporation, a C corporation, had gross