Essay

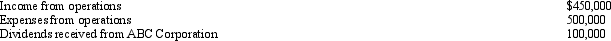

During the current year,Quartz Corporation (a calendar year C corporation)has the following transactions:

Quartz owns 15% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Quartz owns 15% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Correct Answer:

Verified

Quartz has an NOL,computed as ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Tonya,an actuary,is the sole shareholder of Shrike

Q11: Amber Company has $400,000 in net income

Q13: Employment taxes apply to all entity forms

Q21: A corporation with $5 million or more

Q26: Schedule M-1 is used to reconcile net

Q27: Briefly describe the accounting methods available for

Q45: Bjorn owns a 60% interest in an

Q83: Copper Corporation, a C corporation, had gross

Q109: Red Corporation,which owns stock in Blue Corporation,had

Q109: Schedule M-3 is similar to Schedule M-1