Multiple Choice

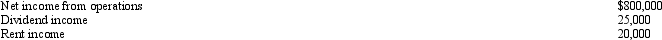

Catfish,Inc. ,a closely held corporation which is not a PSC,owns a 45% interest in Trout Partnership,which is classified as a passive activity.Trout's taxable loss for the current year is $250,000.During the year,Catfish receives a $60,000 cash distribution from Trout.Other relevant data for Catfish are as follows:  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

A) $0.

B) $20,000.

C) $45,000.

D) $112,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: An S corporation has a lesser degree

Q35: The accumulated earnings tax rate in 2012

Q36: Amber,Inc. ,has taxable income of $212,000.In addition,Amber

Q37: The AMT tax rate for a C

Q38: Blue,Inc. ,has taxable income before salary payments

Q40: Actual dividends paid to shareholders result in

Q44: Kirk is establishing a business in 2012

Q120: Mercedes owns a 30% interest in Magenta

Q121: Agnes owns a sole proprietorship for which

Q125: Pelican, Inc., a C corporation, distributes $275,000