Multiple Choice

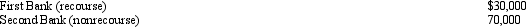

Bart contributes $200,000 to the Fish Partnership for a 40% interest.During the first year of operations,Fish has a profit of $60,000.At the end of the first year,Fish has outstanding loans from the following banks.  What is Bart's at-risk basis in Fish at the end of the first year?

What is Bart's at-risk basis in Fish at the end of the first year?

A) $200,000.

B) $212,000.

C) $224,000.

D) $236,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Walter wants to sell his wholly owned

Q7: A limited partner in a limited partnership

Q43: Amos contributes land with an adjusted basis

Q51: Ashley has a 65% interest in a

Q54: With proper tax planning,it is always possible

Q56: Martin contributes property with an adjusted basis

Q58: Which of the following is not a

Q59: Ralph owns all the stock of Silver,Inc.

Q72: What tax rates apply for the AMT

Q110: The tax treatment of S corporation shareholders