Multiple Choice

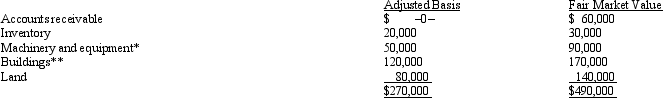

Mr.and Ms.Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms.Smith each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A benefit of an S corporation when

Q20: Kristine owns all of the stock of

Q24: Techniques that can be used to minimize

Q26: In the sale of a partnership,does the

Q29: Which of the following statements is correct?<br>A)The

Q55: A limited liability company (LLC) cannot elect

Q81: Wally contributes land (adjusted basis of $30,000;

Q106: A shareholder's basis in the stock of

Q107: The special allocation opportunities that are available

Q122: Nontax factors that affect the choice of