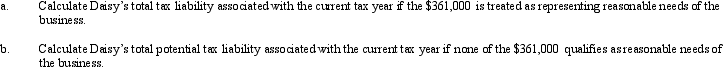

Essay

Daisy,Inc. ,has taxable income of $850,000 during 2012,its first year of operations.Daisy distributes dividends of $200,000 to its 10 shareholders (i.e. ,$20,000 each).Daisy earmarks $361,000 of its earnings for potential future expansion into other cities.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A limited partnership can indirectly avoid unlimited

Q32: Barb and Chuck each own one-half of

Q83: Of the corporate types of entities, all

Q85: If an individual contributes an appreciated personal

Q112: Gerald has a 30% ownership interest in

Q114: Ralph wants to purchase either the stock

Q116: Aaron purchases a building for $500,000 which

Q119: If lease rental payments to a noncorporate

Q143: Which of the following statements is correct?<br>A)

Q162: Factors that should be considered in making