Essay

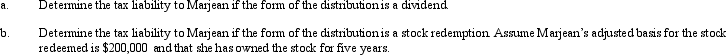

Swallow,Inc. ,is going to make a distribution of $700,000 to Marjean who is in the 35% tax bracket.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q40: Actual dividends paid to shareholders result in

Q44: Kirk is establishing a business in 2012

Q47: Sam and Vera are going to establish

Q49: When a C corporation is classified as

Q65: How can double taxation be avoided or

Q94: Aubrey has been operating his business as

Q110: The tax treatment of S corporation shareholders

Q120: Mercedes owns a 30% interest in Magenta

Q121: Agnes owns a sole proprietorship for which

Q125: Pelican, Inc., a C corporation, distributes $275,000