Essay

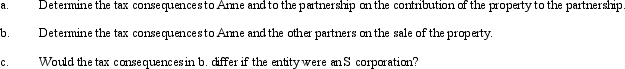

Anne contributes property to the TCA Partnership which was formed 8 years ago by Clark and Tara.Anne's basis for the property is $90,000 and the fair market value is $220,000.Anne receives a 25% interest for her contribution.Because the TCA Partnership is unsuccessful in having the property rezoned from agricultural to commercial,it sells the property 14 months later for $225,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Austin is the sole shareholder of Purple,Inc.Purple's

Q5: Maria has a 70% ownership interest in

Q9: Obtaining a deduction on payments made by

Q45: A corporation may alternate between S corporation

Q76: Why does stock redemption treatment for an

Q84: If a C corporation has earnings and

Q87: The ACE adjustment associated with the C

Q92: After a § 721 contribution by a

Q111: Which of the following is correct regarding

Q113: Do the § 465 at-risk rules apply