Essay

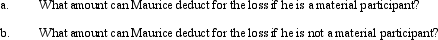

Maurice purchases a bakery from Philip for $410,000.He spends an additional $150,000 (financed with a nonrecourse loan)updating the bakery equipment.During the first year of operations as a sole proprietorship,the bakery incurs a loss of $125,000.Maurice has $300,000 of salary income as the chief financial officer of a publicly-traded corporation.He has interest income of $30,000 and dividend income of $50,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Walter wants to sell his wholly owned

Q11: An S corporation is not subject to

Q58: Which of the following is not a

Q59: Ralph owns all the stock of Silver,Inc.

Q61: Arthur is the sole shareholder of Purple,

Q62: List some techniques for reducing and/or avoiding

Q65: Only shareholders who own greater than 10%

Q67: Barb and Chuck each own one-half the

Q68: What special adjustment is required in calculating

Q69: A limited liability company LLC) is a