Essay

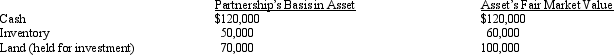

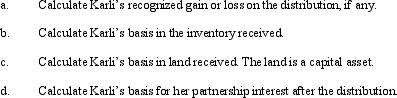

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date,she receives a proportionate nonliquidating distribution of the following assets:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q57: Nicholas is a 25% owner in the

Q85: A partnership is required to make a

Q91: Josh has a 25% capital and profits

Q93: Cynthia sells her 1/3 interest in the

Q95: A partnership has accounts receivable with a

Q99: Marcie is a 40% member of the

Q104: A partnership may make an optional election

Q120: A disproportionate distribution arises when the partnership

Q124: Several years ago, the Jaymo Partnership purchased

Q217: Jonathon owns a one-third interest in a