Essay

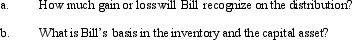

In a proportionate liquidating distribution in which the partnership is liquidated,Bill received cash of $120,000,inventory (basis of $6,000,fair market value of $8,000),and a capital asset (basis and fair market value of $16,000).Immediately before the distribution,Bill's basis in the partnership interest was $90,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: In a proportionate liquidating distribution, Alexandria receives

Q28: Partner Jordan received a distribution of $90,000

Q31: The LMO Partnership distributed $30,000 cash to

Q34: Nicole's basis in her partnership interest was

Q48: In a liquidating distribution, a partnership must

Q52: In a proportionate liquidating distribution in which

Q70: Which of the following transactions will not

Q104: Mack has a basis in a partnership

Q128: In a proportionate liquidating distribution, Scott receives

Q151: Catherine's basis was $50,000 in the CAR