Multiple Choice

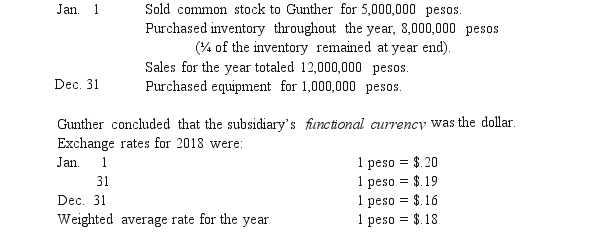

Gunther Co.established a subsidiary in Mexico on January 1,2018.The subsidiary engaged in the following transactions during 2018:

What amount of foreign exchange gain or loss would have been recognized in Gunther's consolidated income statement for 2018?

A) $800,000 gain.

B) $760,000 gain.

C) $320,000 loss.

D) $280,000 loss.

E) $440,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: In translating a foreign subsidiary's financial statements,

Q12: Assume the functional currency is the U.S.Dollar;

Q23: If the current rate used to restate

Q36: Which method is used for remeasuring a

Q39: Perkle Co.owned a subsidiary in Belgium; the

Q40: When preparing a consolidation worksheet for a

Q49: Assume the functional currency is the Euro;

Q71: Contrast the purpose of remeasurement with the

Q82: Prepare a statement of retained earnings for

Q84: Assume the functional currency is the Euro;