Multiple Choice

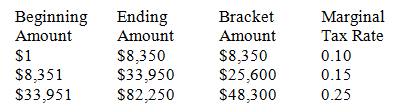

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

-The dollar amount of income taxes paid by a single filer who has taxable income of $8,350 would be:

A) $150

B) $835

C) $3,840

D) $4,675

E) $10,385

Correct Answer:

Verified

Correct Answer:

Verified

Q3: In which form of business organization is

Q7: Patents, trade secrets, trademarks, and copyrights are

Q10: Which of the following are intellectual property

Q13: Which of the following are intellectual property

Q24: Based on 2009 tax schedules,the highest marginal

Q25: The marginal tax rate for the first

Q46: Design patents cover most inventions pertaining to

Q64: Trademarks are intellectual property rights that allow

Q68: "Business method" is one kind of patent.

Q72: The difference between a limited partnership and