Multiple Choice

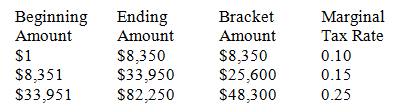

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

-The cumulative dollar amount of income taxes paid by a single filer who has taxable income of $33,950 would be:

A) $150

B) $835

C) $3,840

D) $4,675

E) $10,385

Correct Answer:

Verified

Correct Answer:

Verified

Q18: There are four types of marks that

Q20: Which of the following numbers of shareholders

Q22: Limited liability in the corporate business structure

Q30: A "color mark" is considered to be

Q40: Collective marks cover memberships in groups (e.g.,

Q43: In a general partnership,legal action that treats

Q44: Based on 2009 tax schedules,the highest marginal

Q45: Which of the following is not a

Q67: Partnerships are treated with pass-through taxation. This

Q93: Most trademarks take the form of names,